As we approach the New Year, the United Kingdom continues to face considerable uncertainty regarding the cost of living. However, Vanarama, the car leasing experts, are committed to addressing this issue by offering insights into the anticipated car-running expenses for 2024.

In our most recent car insurance analysis, we have examined 100 different job titles to provide projections for your upcoming year's payments, regardless of whether you operate a petrol, diesel, or electric vehicle.

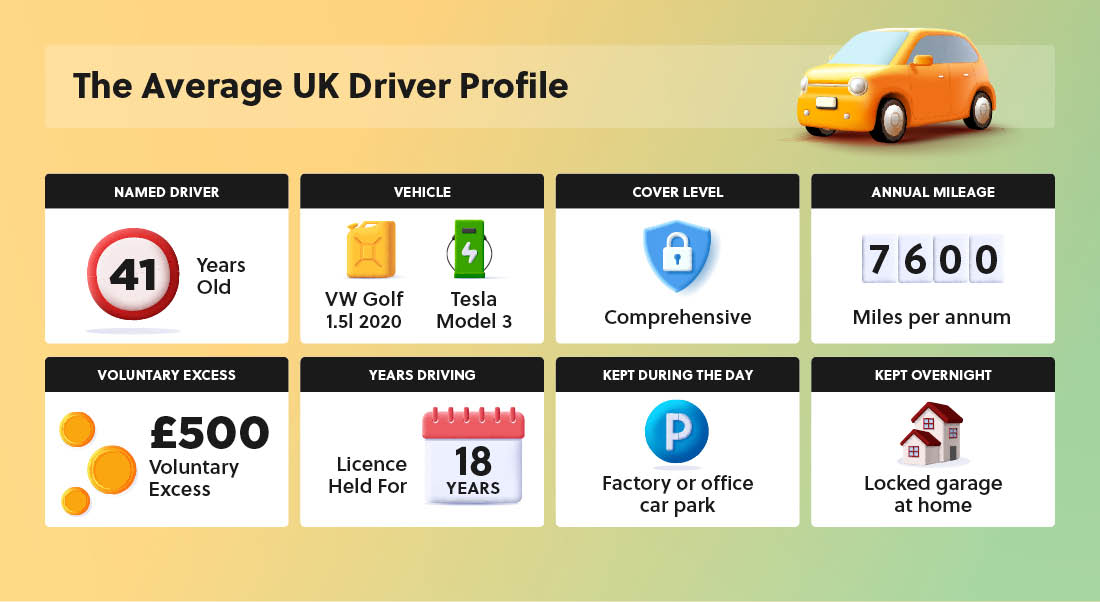

The 2023 report, which predicts 2024 car insurance prices, adheres to the same methodology used in our 2020, 2021 and 2022 reports. In order to minimise variables and maintain a concentrated focus on job titles, we have maintained consistency by utilising the same average driver profile and price comparison website.

The only modifications we've made involve the age of our fictional driver and the accumulation of no-claims years – an adjustment to account for the time that has transpired since our previous analysis. Our hypothetical driver is operating a Tesla Model 3, which was the best-selling electric vehicle in the UK in 2021 and the second-best-selling car overall. We also had them operating in a Volkswagen Golf in order to compare petrol/diesel cars to EVs.

Traders will pay £744.02 per year, the most for car insurance in 2024

Traders are in for a significant shock in the coming year as their insurance costs are set to surge from £474.14 in 2023 to a staggering £744.02, marking a colossal increase of 57%. Following closely are mechanics, facing a potential 61% rise from £453.44 to £728.26. Graphic designers complete the top three with a premium hike from £428.80 to £711.96, signifying a 66% increase - the most significant increase of the year.

The “winners” this year, if you can call them that, are HR Managers. In 2024, they will have the lowest insurance premium, with only a 22% increase taking the cost from £435.27 last year to £529.16.

Since we began our reports back in 2020, mechanics have endured the most substantial price increase, facing a staggering £429.65 surge, while chefs have enjoyed the smallest price bump, witnessing a modest £128.33 increment.

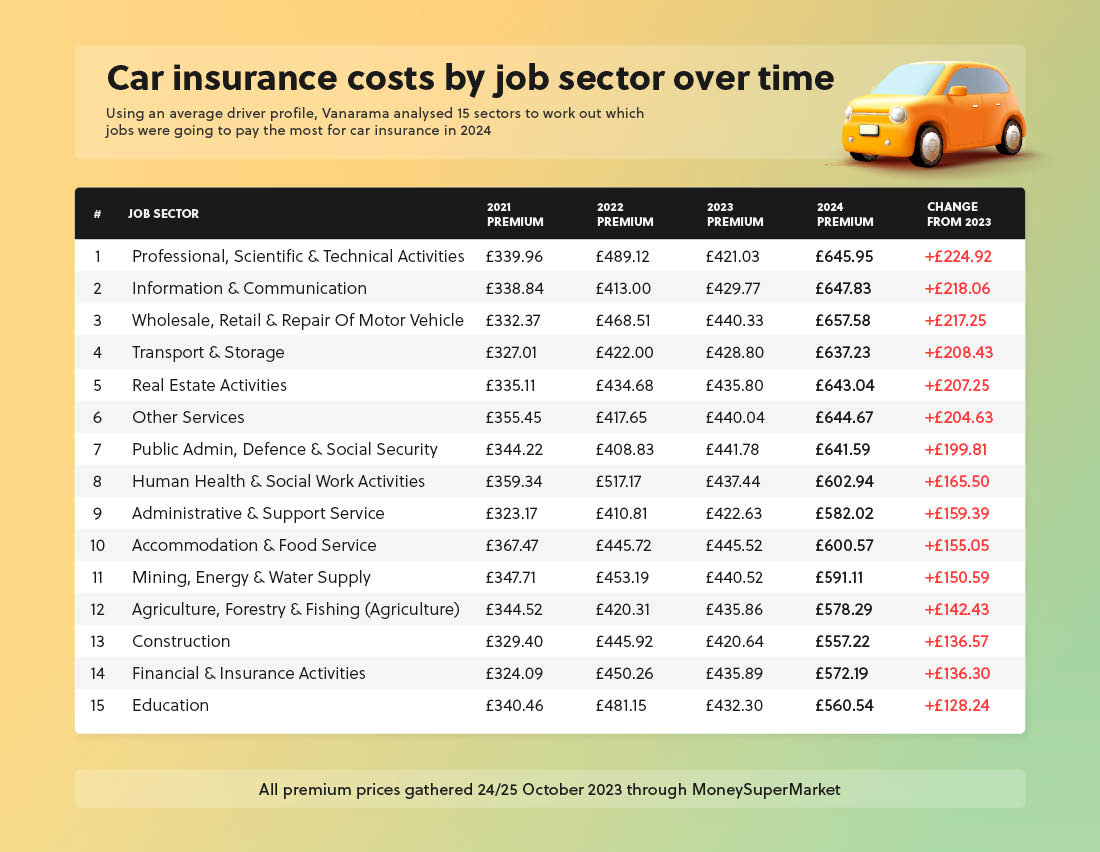

Wholesale, Retail & Repair Of Motor Vehicle sector top premium leaderboard with £657.58 insurance per year

Leading the premium price rankings in the coming year will be individuals involved in the Wholesale, Retail & Repair Of Motor Vehicle industry, facing an increase of £657.58. This marks a substantial 49% rise from the previous year's figure of £440.33. This is also the third highest of the year.

The Information & Communication sector follows closely, with a notable 51% rise in premiums (the second highest) from £429.77 in 2023 to £647.83.

Securing the third spot on the podium are those working in the Professional, Scientific & Technical Activities sector, witnessing their premiums surge from £421.03 to £645.95, signifying the most significant increase this year, at 53%.

The sector “winners” are those who work in construction. In 2024, they’ll be paying the lowest premium at £557.22, up from £420.64 from the previous year. A rise of 32.5% nonetheless.

Insurance premiums sore by 42%

Taking into account our data, drivers in the UK will face a substantial 42% spike in insurance costs in 2024 compared to 2023.

Looking specifically at sectors, the increases are slightly smaller but still significant at 41% in 2024.

The average cost of UK car insurance in 2024 is now £613.91 per year – an 81% increase on 2020's figure, £339.16.

Chefs pay £1,565.83 for EV insurance, more than any other workers

Turning our attention to Electric Vehicles in particular, we can reveal chefs will pay the most for their insurance than any other workers, paying £1,565.83 in 2024, up a massive 138%.

Social workers come in next, with insurance expenses of £1,505.87 for the upcoming year, which is a surge of 130% from the previous year's £655.68. The third spot is occupied by physiotherapists, who will experience a 136% increase in their 2024 premiums, rising from £625.96 to £1,479.03.

If we look solely at the percentage increases, however, we can see that people working in sales are about to be stung the worst. Their EV insurance is set to increase by an astronomical 185% from the previous year. Sales workers are currently spending around £471.29 on EV insurance, which is set to explode up to £1,365.98.

At the other end of the leaderboard, secretaries will be pleased to discover that they will be paying the least for EV insurance in 2024. It is estimated that secretaries will pay around £954.09. But as with all the sectors, that has risen from £445.56 in 2023, which is a 114% increase.

People in the Accommodation & Food Service sector will pay the most for EV Insurance at £1,492.54 per year

Unfortunately, those people working in the accommodation & food service sector, such as chefs, will have to pay the most for EV insurance at £1,492.54. This is up from £644.22 the year prior - a jump of 132%.

Behind them are those working in the financial & insurance activities sector. EV insurance will cost around £1,358.87, up a whopping 153% to £536.38.

Third are the Human Health & Social Work Activities workers who’ll need to pay £1,282.78 for EV insurance in 2024. This is up at an even higher rate of 165% from £483.55.

Public admin, defence & social security is the least costly sector for EV insurance in 2024, according to our data. Workers in this sector will need to pay £1,017.12, which is still up 115% from £472.39 the year prior.

On average, EV drivers will pay £1,150.46 per year for car insurance in 2024.

Next year, the average annual car insurance cost for electric vehicle (EV) drivers is expected to be approximately £1,150.46.

We’ll also see a significant increase in EV insurance premiums, with an average rise of 129% compared to the previous year. This means that EV drivers are now paying more than double the insurance costs they incurred in 2023.

The increased expense demonstrates that, despite the benefits of electric vehicles, insurance coverage for them has become notably more expensive in the current year.

Methodology

Following our car insurance reports in 2020, 2021 and 2022, this update reveals 2024 insurance costs for the same 100 job titles, which were the UK’s most common at the time of researching our first report.

To reduce the variables and focus on the discrepancy in premiums on job title alone, all three reports have been created using the same average driver profile – this is outlined below and covers many factors such as the car being insured, location, relationship status and even where the car is kept at night. The only changes have been the average driver’s age each year and the number of no-claim years.

In all cases, the cheapest premium available was taken from MoneySuperMarket for each job title. Data gathered November 2023.

Average Driver Profile

Usage Social, domestic, pleasure and commuting (SDPC)

Annual mileage 7,600

Kept in the day Office or factory car park

Kept at night Locked garage at home

Cars kept at household One

Vehicle access No access to other vehicles

DOB 26/09/1982 - age 41

Relationship status Married

Homeowner Yes

Children under 16 Yes, one

Address Didcot, Oxfordshire, OX11 7JA

Employment status Employed

Length of time in UK Since birth

Driving licence Full licence, UK issued, includes manual vehicles

Length of driving licence 18 - passed age 23

Medical conditions None

Insurance policies declined or cancelled None

Accident claims or losses None

Driving convictions None

Additional drivers None

Registered keeper and legal owner Yes

Cover type Comprehensive

Payment type Annual

Voluntary excess £500

Years of no claims discount 18 with this or a previous vehicle

Extras e.g. NCD protection, breakdown cover, etc. None

Car (petrol/diesel) 2017-2020 Volkswagen Golf GT TSI EVO 150, 1498cc petrol, 5-door hatchback, manual

Car (electric) 2019-2022 Tesla Model 3 Standard Range Plus Saloon, electric, 4 doors, automatic

Purchased January 2020 (VW Golf), January 2021 (Tesla Model 3)